It is useful to make the distinction between real and nominal values as these concepts are intrinsically related to inflation and used in the financial plans that we build at Exponeta Financial. In addition, these concepts are frequently encountered in economic and financial data sets.

At a high level, nominal values include inflation, and real values do not.

Real Value

A real value has been adjusted to remove the effects of inflation, and is thus stated in terms of a reference year, such as 2015. Real values allow us to directly compare costs from different years without considering inflation.

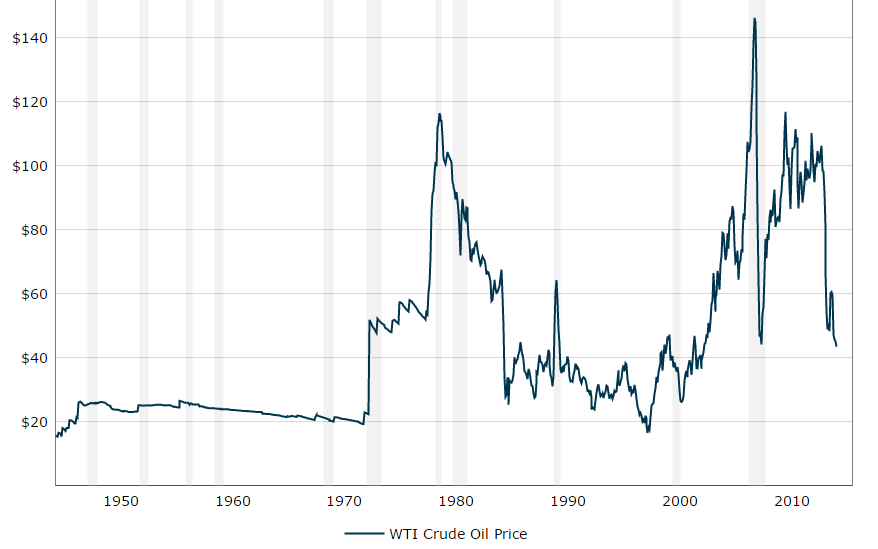

- Example: “In 2015$, WTI oil prices were $23.78/BBL in 1961 and $47.17/BBL in 2015.”

Nominal Value

A nominal value is an actual historical value or a future value expressed in units of “money of the day”. These values include inflation. Typically when prices in the past are quoted they are expressed in nominal values.

- Example: “WTI oil prices were $2.97/BBL in 1961 and $47.17/BBL in 2015.”

- (Note how the 2015 value is unchanged from the real value example, as it is expressed in 2015$ in both examples.

Once inflation is removed and values are converted to real values, the residual price differences for specific objects, like a barrel of WTI oil from 1961 to 2015 are due to factors such as: supply and demand, technology, consumer preferences, and so on. These factors are collectively referred to as cost escalation or de-escalation.

Financial Plans

Typically when we build a financial plan, we work in real dollars, as this allows our clients to easily understand their current and future savings and expenses. We work with real rates of return, and then run sensitivities on the inflation rate to ensure that it does not negatively affect your retirement outcome.

Hopefully this brief article has provided you with a background to understand better the way inflation is applied to financial and economic data. In future articles on this topic we will discuss which asset classes serve as hedges to inflation.